The holiday season inspires a lot of us to come up with resolutions that we plan to commit to in the coming year. Whether it’s breaking a bad habit or learning something new, the New Year is the perfect opportunity to take the first step in bringing healthy lifestyle changes in our lives. That includes taking control of our finances.

While we can’t be too sure if 2021 will be any different from 2020, with much of the country and the world still suffering from the effects of the COVID-19 pandemic, it’ll surely be good to have a positive outlook. Doing so can help you stay committed to your resolutions and improve your chances of reaching your long-term financial goals.

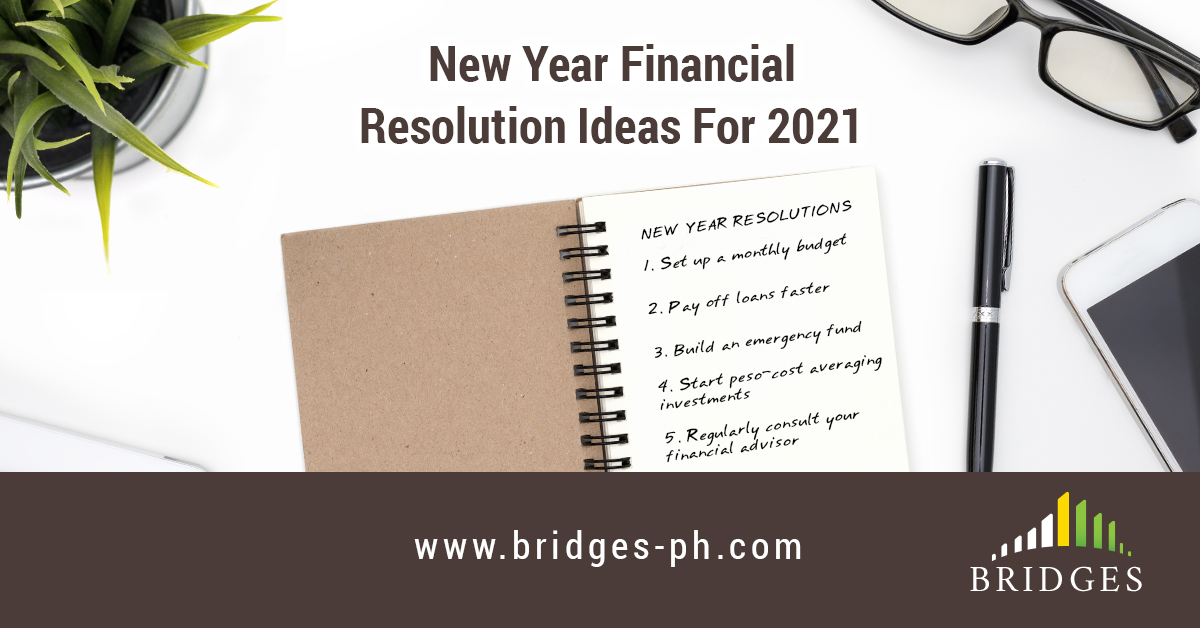

So without further ado, here are some financial resolution ideas for the coming year:

Set up a monthly budget

The simplest thing you can do to manage your money better is budgeting. One such way to do so is to start a monthly monitoring system of your income and expenses. It'll serve as a detailed plan for all your expenses, taking into consideration all your month-to-month needs and perhaps a couple of wants.

From there, figure out how much money you’ll alot for each expense based on your total monthly income. It goes without saying that you should be earning more than what you’re spending. Of course, you also don’t want to spend your entire paycheck. It’s good to leave a percentage for savings or investments.

You might want to try downloading an app or keeping a small notebook handy to keep track of all your spendings. That way, you always have a record of all your financial transactions, making it easier to stick to your budget.

Also, part of having a budget is setting limits to your spendings. Try to avoid using your credit card unless it’s really important.

Pay off loans faster

Remember, the longer it takes for you to pay off your loans, the higher interest becomes. So whatever it is that you have to pay for, try to pay it off as soon as possible.

Yes, this might sometimes be easier said than done. But, if you get organized with your finances, you’ll likely have some wiggle room in your budget to pay off any loans or debts you have yet to fully pay.

Build an emergency fund

If there’s something we can learn from our current situations with the pandemic, it’s that we can’t be too prepared. So, in case you don’t have one yet, it’s highly essential that you build an emergency fund.

You can include this as part of your monthly budget. Set aside a percentage of your monthly income towards a fund, which you can easily access in case of an emergency. Having some money prepared for events such as a health crisis, car breakdowns, or any other unforeseen problems greatly helps in resolving them quickly.

Start peso-cost averaging investments

Peso-cost averaging is an investment strategy wherein you consistently put a set amount of money on investments like mutual funds or stocks over a medium- to long-term period. This typically yields better gains in the long run as investments have more time to mature and are less vulnerable to short-term market volatility. It’s also great at helping you develop the habit of investing and considering your future.

Don’t worry too much about whether or not you’re earning enough to be investing. What’s ultimately important in peso-cost averaging is consistency. Besides, there are a lot of investment options today that let you start out small. And when it comes down to it, investing a small amount at regular intervals is obviously better than not investing at all.

Regularly consult your financial advisor

To ensure you’re always on the right track with your finances, it’s important to regularly consult a financial advisor. After all, nothing beats expert advice. Similar to how a doctor checks your health and prescribes medication, a financial advisor assesses your financial situation and recommends investment plans that can expand your portfolio.

linkiNG you to opportunities,

READ MORE:

- Staying One Step Ahead of Disabilities That Can Put You Out of Action

- How You Can Secure Your Family’s Future From Life’s Uncertainties

- Workplace Stress: The Struggles of Working During A Pandemic

- An Employee’s Guide To Setting Up A Financially Secure Future

- Providing Healthcare Programs For Your Employees Amid The COVID-19 Pandemic

- Perks of Investing At An Early Age